Nicosia – The importance, complexities and applications of Value Added Tax (VAT) were the main points of discussion at the Cyprus VAT Association (CYVA) VAT Forum, held on Tuesday, 1 November 2022 at the Hilton Nicosia.

The Forum was organised by CYVA to celebrate the official public launch of its operations.

The Forum brought together over 100 participants, comprising of representatives from the Court of Justice of the EU, senior Cyprus district court judges, representatives from the Cyprus Tax Department, including the Tax Commissioner, representatives from the International VAT Association (IVA), the Cyprus Chamber of Commerce and Industry (KEVE), the Cyprus Employers & Industrialists Federation (OEB), executives from audit, accounting and legal firms from all over Cyprus and others.

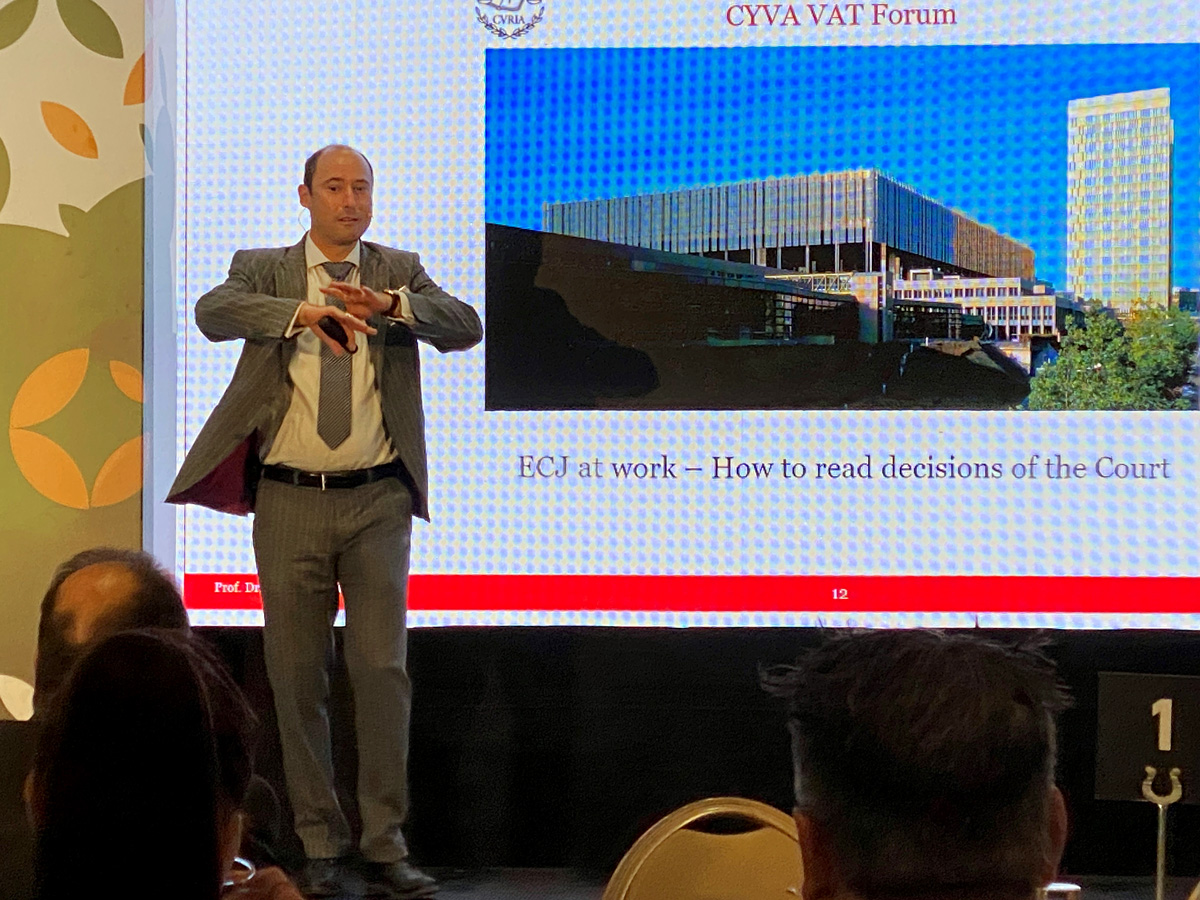

One of the star speakers at the Forum, Prof. Dr. David Hummel, a Referendary for the German Advocate General at the European Court of Justice (ECJ) in Luxemburg, presented the inner workings of the ECJ, analysed how to read decisions of the court and presented ways on how Cyprus Courts can benefit from appealing to the ECJ for various dispute resolutions on VAT.

In an ensuing Panel Discussion, Dr. Hummel discussed with local authority on VAT, Alexis Tsielepis, Managing Director of Chelco VAT Ltd, and renowned local lawyer, Kyriacos Scordis, Managing Partner of Scordis, Papapetrou & Co LLC the importance of VAT to the island’s economy and the need to specialise in VAT in order to understand and handle its complexities.

The three experts pointed out that VAT is by far the largest source of income for governments, including Cyprus and then revealed that Cyprus has never referred a VAT case to the ECJ.

“Judges in Cyprus are generalists and as such do not possess the specialised knowledge needed to rule on a complicated VAT case. Yet, we’ve never asked for the ECJ’s help and guidance,” the two Cypriot experts said, with Scordis going as far as to say that “we consider ourselves to be at the centre of the universe and we think we know it all.”

The Forum continued with a presentation by the Chairwoman of CYVA and Partner with Kinanis LLC, Demetra Constantinou, on the VAT Treatment of Non-Fungible Tokens (NFTs).

Constantinou’s presentation was followed by the unveiling of the new Tax For All (TFA) tax administration system by officers from the Cyprus Tax Department, led by Principal Assessor, Anna Fantarou.

The Tax Department representatives revealed that the first phase of TFA, which is planned to replace TAXISnet, is expected to be implemented by the end of the 1st quarter of 2023.

The second half of the Forum included an update on the work of the European Commission in the field of VAT, presented by and Raymond Feen, Board Member of the International VAT Association (IVA) and Director of ALLVAT Representative BV and Alexis Tsielepis, who is also the Vice-Chairman of CYVA.

Feen also presented to delegates IVA, of which CYVA is a full member, and the networking capabilities of the international association.

The Forum ended with a panel discussion on the impact of technology and digitisation on VAT, comprised of Raymond Feen, Michael Mavrommatis, Partner with Nexia Poyiadjis, George Demetriou, Vice-President of KEVE and Demetris Nisiotis, President of the Cyprus Information Technology Enterprises Association (CITEA).

The Forum was sponsored by Chelco VAT Ltd, Scordis, Papapetrou & Co LLC, Kinanis LLC and Nexia Poyiadjis Ltd.

It was also sponsored by K. Treppides & Co Ltd and supported by GDK Optimus Audit Services Ltd, CEA Audit, Andreas Konnaris LLC, LSTS Consultants Ltd and Andersen.

The Forum was organised by IMH.

Cyprus VAT Association (CYVA)

CYVA was established in 2019 with the aim of providing a unified and independent voice to all professionals and businesses in Cyprus on VAT matters.

According to the Association’s Articles of Association, its main objectives are to promote VAT tax, legal and related matters with the Government, the House of Parliament and the Tax Department for the purpose of adopting and implementing them. Also, to contribute to the proper adoption of VAT European Directives and Regulations, to help modernise and simplify the Cyprus VAT legislation, and to liaise and consult with the European Commission and other international bodies on Cyprus VAT matters.

Also, to educate its members, professional bodies, and state and non-governmental organisations on VAT matters and to serve and safeguard the public interest in matters of indirect taxation.